kern county property tax rate

Please select your browser below to view instructions. Kern County Property Taxes in Keene CA.

In Kern County the average property tax rate is 08 making property taxes slightly higher than the state average.

. Box 541004 Los Angeles CA 90054-1004. Kern County Building Inspection. Search for Recorded Documents or Maps.

Tax bills were mailed to all property owners whose addresses were on file with the county assessor as of Jan. Find Kern County Online Property Taxes Info From 2021. Get Information on Supplemental Assessments.

This means that residents can expect to pay about 1746 annually in property taxes. Cookies need to be enabled to alert you of status changes on this website. Name A - Z Sponsored Links.

Tax rate set by County Irrigation District Bonds and Debt. Change a Mailing Address. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Kern County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps youre unfamiliar that a real estate tax levy sometimes is more than it should be because of an inaccurate appraisal. File an Assessment Appeal.

How Kern County property taxes are determined. The first installment of Kern County property taxes is due by 5 pm. Lake Isabella CA 93240.

Look up the current sales and use tax rate by address Data Last Updated. How much are property taxes in Bakersfield CA. Ad One Simple Search Gets You a Comprehensive Kern County Property Report.

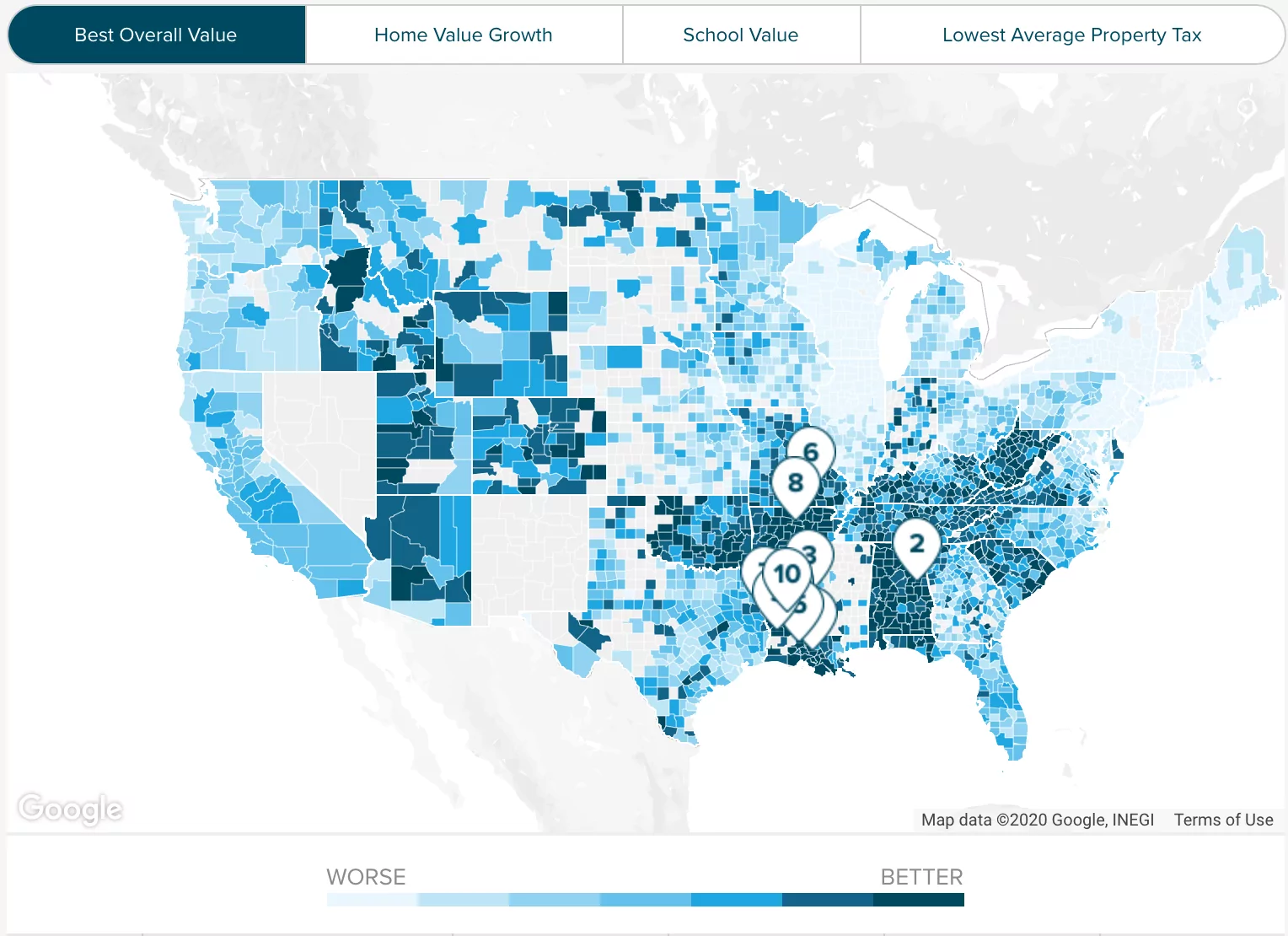

By Jordan Kaufman Kern County Treasurer-Tax Collector First and foremost I would like to say that I understand and share the publics anxiety and concern about the impacts of the COVID-19 pandemic crisis. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. Effective tax rate Kern County 00101 of Asessed Home Value California 00076 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Kern County 2159 California 3818 National 2471 Median home value Kern County 213900 California 505000 National 217500 Median income Kern County 53350 California.

Purchase a Birth Death or Marriage Certificate. Find Property Assessment Data Maps. As the Kern County Treasurer-Tax Collector it is my responsibility to balance the interests of Kern County residents businesses and communities with.

What is the sales tax for Fresno CA. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. 725 2022 Kern County sales tax Exact tax amount may vary for different items Download all California sales tax rates by zip code The Kern County California sales tax is 725 the same as the California state sales tax.

Payments can be made on this website or mailed to our payment processing center at PO. I hope you find this website informative and helpful and that you return regularly to see what is happening in our office. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of 080 of property value.

119 south kern rosamond county of kern county 120 south fork county of kern county 121 standard county of kern county 124 taft outside county of kern county 125 tehachapi outside county of kern county. Tax rate areas tra area zoning contact 001 city of bakersfield city of bakersfield 002 city of delano city of delano. The property tax rate in the county is 078.

10 a press release from Kern County. See reviews photos directions phone numbers and more for Kern County Property Taxes locations in. The Assessor values all taxable property in the County.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. 2001-2002 Annual Property Tax Rate Book. - A PROPERTY OWNER CANNOT BUY THEIR OWN PROPERTY AT A TAX SALE FOR LESS THAN THE TAXES.

561-562 Assessed Valuation of Schools and Other Special Districts. Please enable cookies for this site. 1115 Truxtun Avenue Bakersfield CA 93301-4639.

7050 Lake Isabella Blvd. County Parish Government Government Offices. File an Exemption or Exclusion.

Total Assessed Valuation of Kern County. Here you will find answers to frequently asked questions and the most commonly requested. Service charge by parcel.

Request a Value Review. To avoid a 10 late penalty property tax payments must be submitted or postmarked on or before Dec. The assessment roll is prepared by the Assessor.

Our Kern County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in California and across the entire United States. The average effective property tax rate in California is 077 compared to the national rate which sits at 108. Stay Connected with Kern County.

California Mortgage Relief Program Property Tax Assistance. Auditor - Controller - County Clerk. Kern County collects.

Kern County Assessor-Recorder County Terms of Sale - March 2022 Kern County General Tax Sale Information Kern County Tax Sale Brochure List of Title Companies Tax Rate Areas Zoning Departments Zoning Information News and Announcements. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. Of course exact tax rates vary based on factors like assessed property value.

Kern County Treasurer And Tax Collector

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

California Public Records Public Records California Public

Riverside County Ca Property Tax Calculator Smartasset

Kern County Ca Property Tax Search And Records Propertyshark

Pin On Articles On Politics Religion

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Kern County Treasurer And Tax Collector

Kern County Ca Tax Rate Areas Gis Map Data Kern County California Koordinates

Kern County Treasurer And Tax Collector

New Homes For Sale In Rosamond California Tour Our Well Crafted Homes In Rosamond Broker S Welcome Open House Invitation Open House New Homes For Sale