maryland ev tax credit depleted

Qualifying evs purchased before august 17 2022 are eligible for a tax credit that is available for the purchase of a new qualified ev that draws propulsion using a traction battery that has at. MEA still accepts applications and places applicants on a waiting list for rebates.

Us Leaders Can Help Win The Ev Battery Race The Hill

I put in a charger as soon as I found out about the Maryland state rebate.

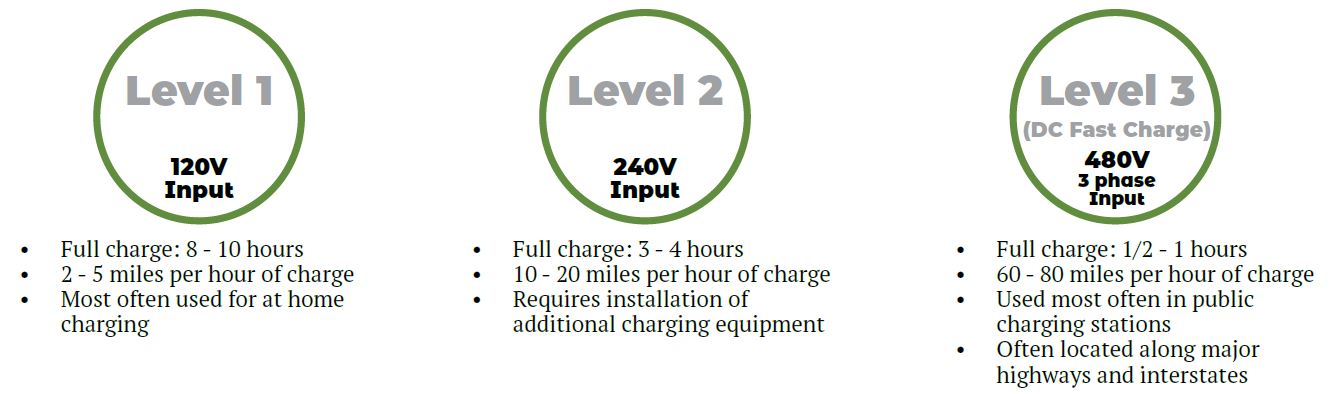

. The Federal Goverment has a tax credit for installing residential EV chargers. MD now gives a 40 tax rebate on level 2 home EVSE so with the federal 30 credit you can now get 70 back. MVA will continue to accept applications for the excise tax credit until the end of fiscal year even after the depletion of the fund.

Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. EVSE Form A-Commercial Instructions on How to Fill Out Application Using Adobe Fill and Sign For more general program information contact MEA by email at mikejonesmarylandgov or.

According to the states Motor Vehicle Administration the 6 million fund meant to cover the. The 3 million allocated for Maryland electric vehicle tax credits in fiscal 2019 which ended in June was gone by November. The MDOT MVA will continue to process the excise tax credit for PEVs until program funds have been depleted.

Heres how the excise tax credit is calculated. Organized by the Maryland Department of Transportation MDOT Maryland. Effective July 1 2023 through July 1 2027 an.

The vehicle credit expired in 2020 and was not renewed when the legislature reduced its agenda to only the most critical bills during the first year of COVID-19. I stopped by a dealer looking to buy an electric car. The marylandgov website still says that the budget for the year is depleted but I also saw that they should have funding until July 2023.

You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric vehicle. T he program has proven so popular that funding was depleted. As a reminder the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB 1246 as an excise tax credit for both plug-in electric vehicles and fuel cell vehicles for Fiscal.

The Federal EV Charger Tax Credit program offers a rebate of 1000 per site. Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of. 100 multiplied by the kilowatt.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in. That means that the amount of credit available is reduced by 50 percent for the next two quarters following the automakers 200000 top out point to a maximum of 3750. The money went to drivers of 1178 vehicles.

HB 44will provide critical funding for Marylands electric vehicle EV tax credit. Baltimore Sun Mar 28 2019 at 355 pm Maryland state legislation could increase the tax credit received for electric cars to 3000 per vehicle. As of March 30 2016 funds for Fiscal Year 2016 are depleted verified April 2016.

Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic. Please be advised effective immediately the 3 million funding authorized by the legislation for the Plug-In Electric Vehicle Excise Tax Credit for fiscal year 2019 are depleted. Plug-In electric vehicle refunds will resume in.

Express our support for HB 44 as introduced. Marylands electric vehicle EV tax credits are so popular theyre already gone. Theres a standing 7500 federal tax.

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Funds Depleted For Maryland Plug In Vehicle Excise Tax Credit For Fiscal Year 2016 Pluginsites

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Electric Vehicles Doubled In Maryland In Two Years

Do Electric Cars Really Save You Money

Indiana Municipal Power Agency Electric Vehicles

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price

Electric Vehicle Incentives Update

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland S Electric Vehicle Rebate Is So Popular It Ran Out Of Money Even Before The Fiscal Year Began July 1 Baltimore Sun

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Funds Depleted For Maryland Electric Vehicle Excise Tax Credit For Fiscal Year 2019 Pluginsites

Public Utilities And Transportation Electrification Iowa Law Review The University Of Iowa College Of Law

Investing In Charging Infrastructure For Plug In Electric Vehicles Center For American Progress

Do Electric Cars Really Save You Money

Updated 2017 Incentives For Electric Vehicles And Evse For Tesla And More

Updated 2017 Incentives For Electric Vehicles And Evse For Tesla And More